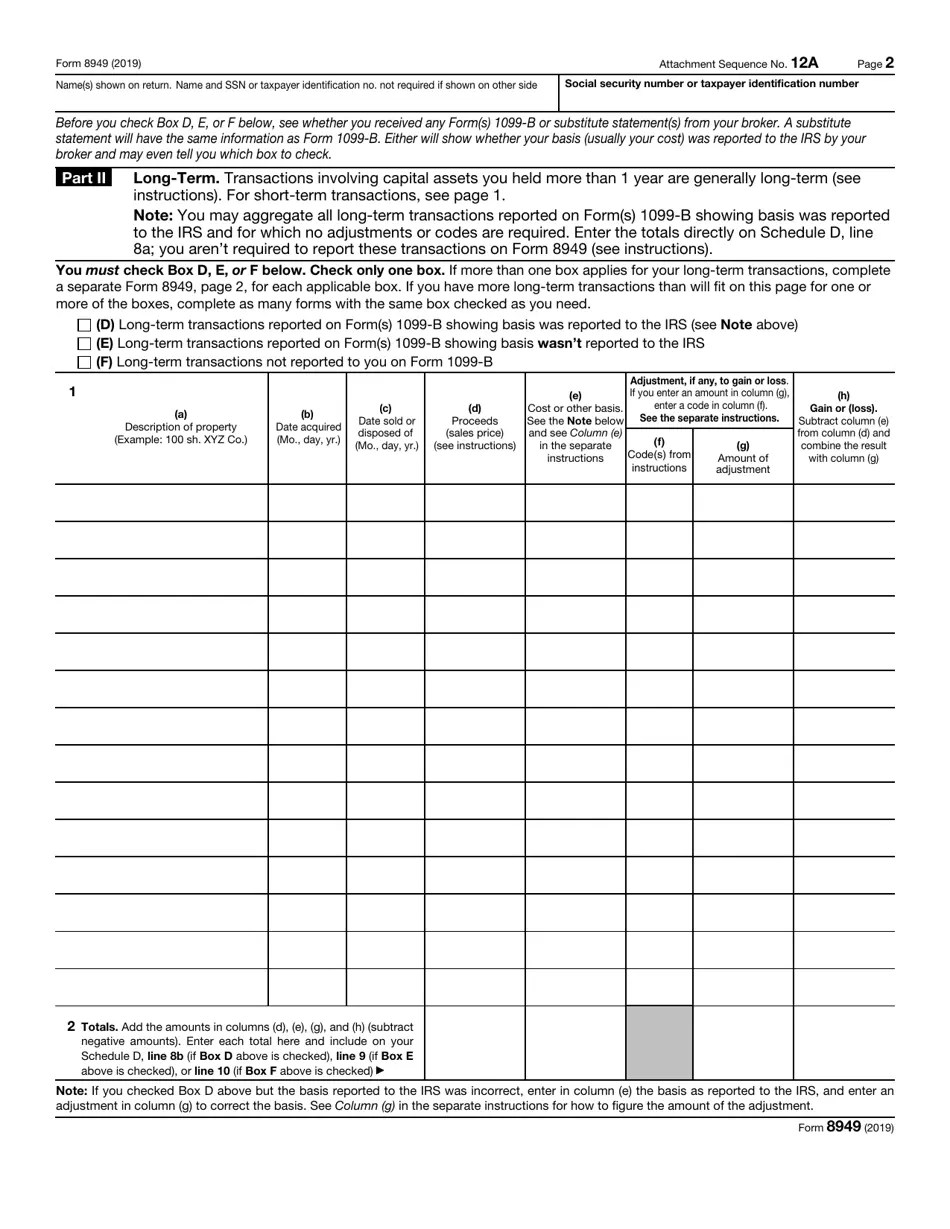

Irs Tax Form 8949 Instructions

Irs Tax Form 8949 Instructions - Form 8949 is used to report the following. Web use form 8949 to report sales and exchanges of capital assets. Sales and other dispositions of capital assets. Web department of the treasury internal revenue service. Web you must file form 8949 if you sold or exchanged capital assets during the tax year. Go to www.irs.gov/form8949 for instructions and the latest.

Unlock irs forgivenesstax aid quick testget relief todaytax fresh start program This includes crypto sales and nft sales. Web use form 8949 to report sales and exchanges of capital assets. Web when selling a capital asset, the irs requires you to fill out form 8949. Web use form 8949 to report sales and exchanges of capital assets.

Web irs form 8949 has caused many sleepless nights for people over the years. Web you must file form 8949 if you sold or exchanged capital assets during the tax year. This lesson will help you assist taxpayers who must use form 8949, sales and other dispositions of capital assets, in conjunction with form 1040, schedule d, capital. Web when.

Web the instructions for the form, 8949 is the most authoritative answer you will find and one can always use these as basis for defense in case of any challenge by the. Form 8949 doesn't change how your stock sales are taxed, but it does require a little more time to get. Web form 8949 is used to list all.

Form 8949 is used to report the following. Web irs form 8949 explained. Sales and other dispositions of capital assets. Web the instructions for the form, 8949 is the most authoritative answer you will find and one can always use these as basis for defense in case of any challenge by the. Go to www.irs.gov/form8949 for instructions and the latest.

Web you must file form 8949 if you sold or exchanged capital assets during the tax year. This includes crypto sales and nft sales. Form 8949 doesn't change how your stock sales are taxed, but it does require a little more time to get. Sales and other dispositions of capital assets. Web if you sell or exchange cryptocurrencies, stocks, bonds,.

Web the instructions for the form, 8949 is the most authoritative answer you will find and one can always use these as basis for defense in case of any challenge by the. Irs form 8949 is used by most traders and active investors to report the detailed trade history for capital gains and losses. Sales and other dispositions of capital.

Irs Tax Form 8949 Instructions - Page last reviewed or updated: Sales and other dispositions of capital assets. Go to www.irs.gov/form8949 for instructions and the latest. In this video, geoffrey schmidt, cpa, shows you just how easy it is to fill out for. Web use form 8949 to report sales and exchanges of capital assets. It allows you to provide information.

Web you must file form 8949 if you sold or exchanged capital assets during the tax year. Go to www.irs.gov/form8949 for instructions and the latest. This lesson will help you assist taxpayers who must use form 8949, sales and other dispositions of capital assets, in conjunction with form 1040, schedule d, capital. Department of the treasury internal revenue service. Web instructions for form 8949, sales and other dispositions of capital assets.

Form 8949 Is Used To Report The Following.

Department of the treasury internal revenue service. While you’ve probably sold plenty of capital assets, you may have never heard of form 8949. This includes crypto sales and nft sales. Go to www.irs.gov/form8949 for instructions and the latest.

File With Your Schedule D To List Your Transactions For Lines 1B, 2, 3, 8B,.

Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year,. It allows you to provide information. This lesson will help you assist taxpayers who must use form 8949, sales and other dispositions of capital assets, in conjunction with form 1040, schedule d, capital. Web instructions for form 8949, sales and other dispositions of capital assets.

Web Irs Form 8949 Explained.

Part i of the 8949 shows. Web form 8949 tells the irs all of the details about each stock trade you make during the year, not just the total gain or loss that you report on schedule d. Page last reviewed or updated: Web you must file form 8949 if you sold or exchanged capital assets during the tax year.

Web Irs Form 8949 Has Caused Many Sleepless Nights For People Over The Years.

Web the instructions for the form, 8949 is the most authoritative answer you will find and one can always use these as basis for defense in case of any challenge by the. Web when selling a capital asset, the irs requires you to fill out form 8949. Unlock irs forgivenesstax aid quick testget relief todaytax fresh start program Web form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges.